Part loyalty programme, part fan club, âcommunity commerceâ platforms are the latest tech trend gaining traction with beautyâs biggest players.

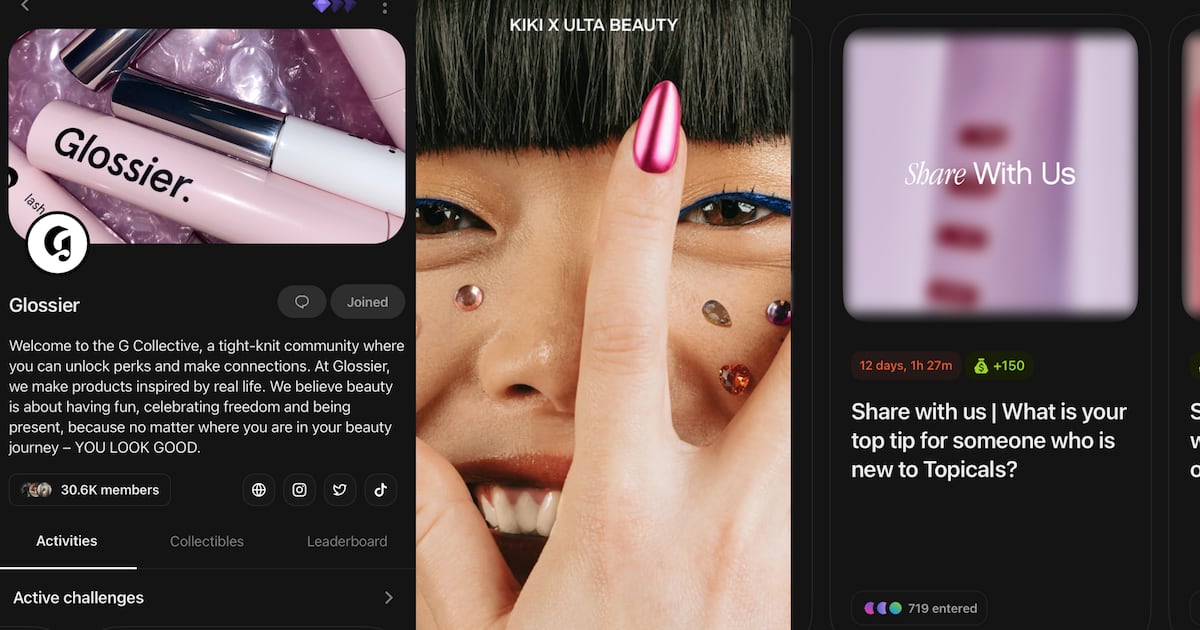

On Aug. 28, Ulta Beauty was announced as the first retail partner of Kiki World, an Estée Lauder Companies-funded beauty start-up that incentivises member engagement. In July, Glossier joined a beauty-heavy roster of over 80 brands on TYB, a community rewards platform and the brainchild of Outdoor Voices founder Ty Haney, with over 30,000 members joining its G Collective group on the app. Both have received investment from crypto-focused VC firms, getting brands to embrace âWeb3â³ tech-related concepts long after the end of 2021â²s NFT craze. The new partnerships mark the latest effort by beauty companies to build stronger online âcommunities,â which many have done through formats such as group chats on Instagram or social apps like Geneva.

The benefits, brands argue, are worth it. The concept of creating a brand âcommunityâ has become paramount in beauty marketing, and both TYB and Kiki World allow brands to award loyalty points for purchases and brand-related social interactions. TYB also offers group chat functionality, where brands can send updates and communicate back and forth with members.

These platformsâ rise comes as beauty brands, facing stubbornly high ad and customer acquisition costs, are shifting their focus to customer retention. Though still in their early stages â TYB has been around for two years and Kiki World for one â they offer brands a way to experiment with new loyalty and communication formats to stay relevant with a Gen-Z audience, as well as ways to increase user-generated social content as it grows in importance compared to influencer marketing.

And for the consumers, it allows them to get closer to their favourite brands than ever before.

âWeâre seeing this shift across the beauty space in terms of brands and consumer engagement and community building, and really this transformation of behaviour and expectations of consumers,â said Shana Randhava, the SVP of Estée Lauder Companiesâ investment and incubation arm New Incubation Ventures, which was revealed in April 2024 as an early investor in Kiki World, along with Andreesen Horowitzâs crypto fund a16z crypto and others that invested a total of $7 million in initial funding.

Next-Generation Loyalty

Community commerce platformsâ loyalty offerings are perhaps their biggest draw.

TYB allows brands including Glossier, Rare Beauty, Ouai and Dieux to offer loyalty points for activities called âchallenges.â With the challenges, customers are rewarded for simple actions â Glossier, for example, gives customers 50 points for answering a quiz question or 100 points for submitting a selfie that can be featured on the brandâs social channels. Those points can then be used for discounts on products via an embedded tool or discount code on Shopify checkout, with 100 points equaling $1 off. Glossierâs TYB account marks its first-ever DTC loyalty program, which the brand had shied away from for years.

Haney said that as an âOG of community-building,â Glossierâs adoption shows how even DTC brands are looking for new ways to cultivate online loyalty.

âIn a lot of ways, the direct-to-consumer business model is flawed in that the most important relationships a brand has, those with its customers, are intermediated with discovery-optimised ad platforms,â she said, adding that the idea for a customer retention-focused platform was born out of her own time in the DTC sector. âWeâve spent all of this money on Instagram and Facebook to acquire customers, customers who we donât necessarily have first-party data for or a relationship with. And ultimately, it leads to a lot of one-and-done customers, which is a very expensive model.â

Even brands that had previously experimented with loyalty programmes have embraced TYBâs approach. Topicals, the first brand to join TYB in 2022, migrated its entire DTC loyalty programme over to the platform in the fall of 2023, transferring customersâ points over.

âTYB gives us a whole different level of connection,â said Grace Sofia Caro, community impact manager at Topicals. âItâs just a much deeper level of connection aside from the points and purchases of a normal loyalty programme.â Beyond points for purchases, Topicals offers members rewards for a wide variety of challenges, including creating social content about the brand such as videos that offer them the chance to win spots on its influencer trips.

Kiki Worldâs model, meanwhile, is centred on collecting user feedback to shape production of its own products. The platform partners with influencers to create a range of product prototypes, and then awards loyalty points to users who vote on which products the brand should make. The Ulta Beauty team-up is its first partnership with an outside brand; it will allow users to access Kiki campaigns through Ulta Beautyâs website and earn exclusive collectibles.

âAll of your feedback is rewarded,â said Kiki World founder and CEO Jana Bobosikova, who created the platform with the concept that the ânext generation of brands will not be created and sustained top-down.â

Cultivating a Customer Community

Beyond tangible loyalty, brands have been laser-focused on the concept of âcommunityâ in recent years â a nebulous term referring to ways they try to create a friend-like affinity in customersâ minds.

The search for community has taken several forms, starting with private Facebook groups, moving on to invite-only Instagram groups, chat-specific apps like Geneva and most recently, Instagramâs broadcast channels. Community commerce apps are positioning themselves as a Gen-Z-friendly version.

Glossier previously used a private Facebook group as a community hub, but has moved to TYB, which Kristin Kim, Glossierâs VP of brand and product marketing, said functions as âa close-knit space where it feels like weâre chatting with a circle of good friends.â Glossierâs group chat currently features brand announcements on new challenges or a heads-up about promotions such as free samples at the US Open. User comments include product feedback and links to their social posts about the brand.

Brands are also leveraging the platforms to engage with their influencer ambassadors. Topicals moved its group chat for its ambassador programme to TYB in August 2024 after previously operating on Slack-like group platform Geneva. Customers, too, can access perks often reserved for influencers on these platforms: Topicals also uses the app to send invites to in-person events across the US, while skincare brand Mario Badescu selected 40 members of its TYB group to sample and review a recent face spray launch.

The community and loyalty incentives appear to be the biggest draw for these platforms, rather than their connection to emerging tech â both count crypto funds among their investors, operate on the blockchain and offer NFT-esque digital âcollectibles.â But fashion and beautyâs NFT obsession has faded, and now even carries some stigma.

So far, it hasnât been a deterrent: In the next quarter, Kiki World will be launching what Bobosikova calls a âpermissionless version of Kiki,â which will allow partners to use its platform with their own brands; around 50 brand and influencer partners are lined up to join. TYB has more beauty brands slated in the coming months and is also venturing into fashion: Cult Gaia and Urban Outfitters are members.

âHigher engagement leads to greater loyalty. Thatâs not a novel concept; Iâm not saying anything earth-shattering there. What is different about Gen-Z is how and where and how often that engagement is happening,â said Randhava.