This yearâs holiday shopping season looks to be somewhat muted.

The National Retail Federation forecasts US holiday retail sales will grow around 3.5 percent, the slowest pace in six years. Though inflation has come down from its 2022 peak, higher prices are still weighing on consumer spending. And this year, retailers have another hurdle to contend with: Thanksgiving falls later than usual this year, shortening the lucrative spending window before Christmas.

âNo one thinks itâs going to be a blowout this year,â said Sarah Engel, a president at consultancy firm January Digital.

Compounding the damage is a feeling of choice fatigue among shoppers: a study from management consultancy firm Accenture found that 72 percent of respondents experience âbuyersâ blockâ and donât buy anything when faced with too many options.

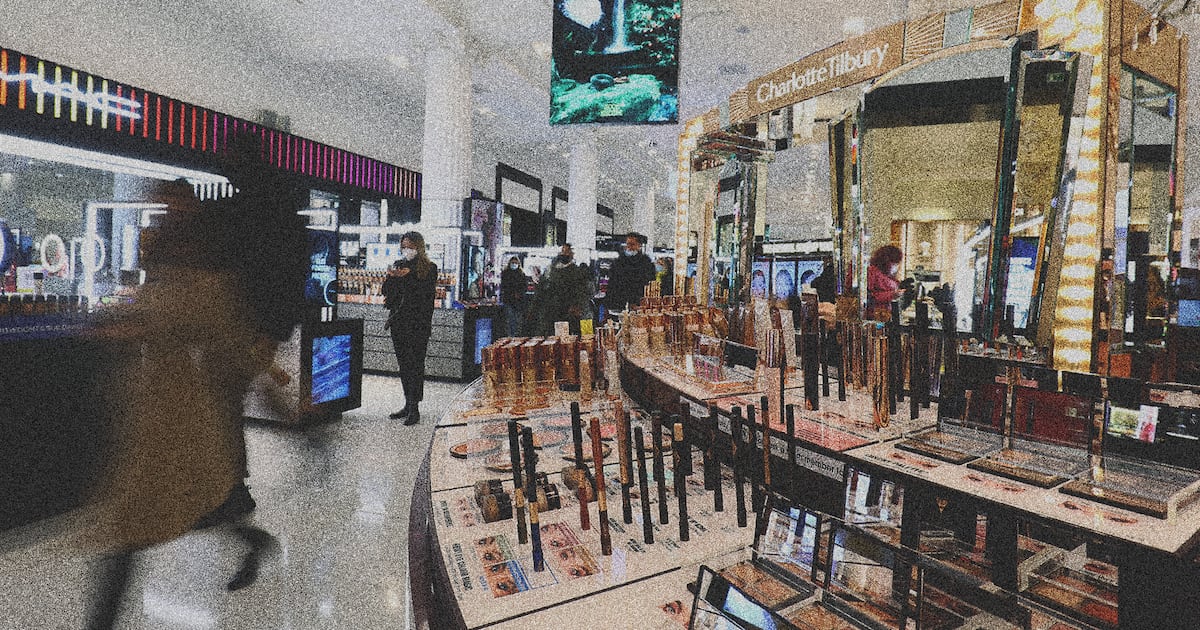

All consumer sectors rely on the period between Thanksgiving and Christmas to buoy their earnings, but the holidays represent an especially important season for beauty brands. Dedicated promotions, sets and bundles not only represent a significant chunk of their earnings, but also serve as an opportunity to recruit new customers.

Even with just moderate growth expected, beauty brands still have reason to be hopeful. The sector benefits from a close association with gifting and the stronger emotional ties that can bond shoppers to premium brands. Itâs not that consumers wonât be spending or seeking out extra-special gifts (for loved ones or for themselves), but that theyâll be more motivated by convenience and value.

âNewness is what drives customers in ⦠anything to make it an experience and really showcase the products,â said Joe Shasteen, global general manager at retail analytics firm Retailnext.

To counteract the headwinds, brands should think about agile, low-lift ways to communicate that they can deliver on these fronts, from offering flexible payment plans and delivery to amplifying user-generated content as advertising.

Gift Now, Pay Later

Feeling more pressure, American shoppers will be relying on credit cards and buy now, pay later (BNPL) services when making their holiday purchases this year. Almost half of consumers say that theyâre carrying more credit card debt today compared to 2023, in order to âoffload a lot of the cost of inflation onto their credit cards,â said Salesforceâs director of consumer insights and strategy Caila Schwartz. Meanwhile, 28 percent of shoppers say theyâll use BNPL for the holidays, a figure that jumps to 67 percent amongst parents, according to research from payments firms Splitit and Pymnts.

Thanks to âSephora tweens,â the Gen-Alpha shoppers who covet premium items like Summer Fridays lip balms, Drunk Elephant serums and Rhode blushes, beauty gifts will likely be top of the list for a lot of parents, said Schwartz.

Engel said some companies are now using BNPL as a promotional lever. âIt used to be on the checkout page, now itâs on the homepage or product page,â she said, referring to integrations for BNPL services like Klarna and Afterpay.

Offering some payment plans is one way to win over shoppers, but many are also seeking out more flexibility in terms of the product offering or delivery logistics. Schwartz and Engel said that buy online, pick up in store (BOPIS) or curbside collection programmes would likely be especially popular given the shorter shipping timeframe this year, and that more lenient shipping windows or delivery options can help increase spend. Schwartz added that Salesforce data indicated retailers who offer BOPIS see their revenues grow between five to seven times faster during the run-up to Christmas than those who donât.

Brands that can master flexible logistics have another advantage: by making it easier for the customer to get their orders, they can give the perception of a better deal, even without offering a discount.

âThose times of value-based services are usually a lot better at protecting margins,â Engel said.

The Price of Value

Shoppers of all income levels are united by one factor: the desire for value.

While promotions are a straightforward way to communicate a good deal, timing them accurately is paramount. Salesforceâs data indicates that âCyber Weekâ â the seven days that follow Cyber Monday after Black Friday â is when consumers most expect discounts, and are most excited to spend.

âA lot of consumers wait for that time,â Schwartz said. âThereâs a lot of pent-up demand.â

To cut through the noise while protecting margins, cyber week offerings donât necessarily need to be steeply discounted. Schwartz said gift sets, which offer a marginal saving on buying the products individually, or limited-edition merchandise or items exclusive to specific retailers or online-only are another way to tap into the excitement.

Brands can also think of add-ons that go beyond the holiday season, like gifts with purchase, invitations to private shopping seasons or spend-based tiered loyalty programs. Allowing customers to build a bundle of items for a small saving or complimentary gift wrapping can also be motivational.

âAnything that makes [shopping] feel unique and curated,â said Engel.

Offering gift wrapping, or packaging with giftable presentation, can also help increase a productâs value proposition, as well as encouraging store staff to spend as much time as possible with customers to make the shopping experience feel special and personalised. Even a small discount can be enticing for brands that rarely go on sale, but it can become a slippery slope â brands need to be mindful of when they go on sale and go back to full price each year, Engel said.

With the holiday season starting in earnest next week, there are still a few options available for brands and retailers to increase their sales. Engel suggested looking across social media for user-generated content about your brand and working with those creators to promote or republish that material as advertising, rather than trying to create fresh content in-house. Trying new platforms or strategies, like TikTok Shop or live stream selling can also be a lower lift, she said.

âBrands have this attitude now of âletâs give it a try,ââ she said. âIt might not move as much as a big Google or Meta campaign, but itâs an opportunity.â

Sign up to The Business of Beauty newsletter, your must-read source for the dayâs most important beauty and wellness news and analysis.